Government moves the goalposts on super again

The proposed tax calculation for the $3 million threshold for super will see accountants grappling with new layers of complexity.

Despite releasing an objective for super only the week before, the government last week announced a new measure on 28 February which would reduce the tax concessions in super for those with balances above $3 million.

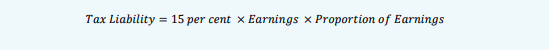

Speaking in a press conference, Prime Minister Anthony Albanese stated that from 2025-26 onwards, the tax rate applied to future earnings for balances above $3 million will be 30 per cent.Currently, earnings from superannuation in the accumulation phase are taxed at a concessional rate of up to 15 per cent.

The measure is expected to impact around 80,000 people. Individuals with balances above $3 million will still be able to benefit from the more generous tax breaks on earnings from the $3 million they have below the threshold.

The SMSF Association and joint accounting bodies have outlined some significant concerns about the measure but there is some relief that the government has decided against imposing a hard cap which would have required excess funds to be withdrawn from the system.

Chartered Accountants ANZ Superannuation and Financial Services Leader Tony Negline said the target of these rules is a relatively small number of people who played by the rules which the government at the time had set.

Associations have also warned that imposing yet another change to the tax concessions in super may further dampen confidence in the superannuation system.

“Investing in superannuation in this country is like trying to shoot a moving target flying in circles over shifting goal posts,” stated Mr Negline.

IPA general manager, technical policy, Tony Greco agreed that members who have been directly impacted and that based their decision on the rules of the day will draw little comfort from the statement ‘it is not retrospective’.

“Moving the goalpost makes this announcement retrospective. The younger generation will be watching, and thinking about what the future government will do with their balance, which isn’t something that promotes certainty,” cautioned Mr Greco.

Mr Greco noted that it wasn’t that long ago that Australians were being encouraged to add to their superannuation balances.

From 10 May to 30 June 2007, individuals were encouraged by the government of the day to take advantage of a one-time opportunity to pour $1 million into their superannuation funds before limits were imposed.

“Are we being haunted by the Ghost of Christmas Past?” he questioned.

“Australians made financial plans based on advice from a previous past Treasurer, Peter Costello, which encouraged people to do one thing, only to be penalised for it later when a new government decides to change policy direction and declares that they have too much money in superannuation?”

Both the SMSF Association and accounting bodies expect the new threshold will add further complexity and add further layers to the system for practitioners to navigate.

The changes have been welcomed by the APRA-regulated side of the super industry, with the Australian Institute of Superannuation Trustees regarding the measure as an important stage in addressing the inquiry of tax concessions in superannuation.

“It’s appropriate that people with very high balances like this, which are more than what is needed to fund a comfortable retirement, will pay more tax,” said AIST chief executive Eva Scheerlinck.

“It’s also worth noting that the proposal of 30 per cent tax on earnings is still lower than the highest marginal tax rate, so there is still a tax benefit from the money remaining in super.”

Details of the earnings tax calculation

Shortly after announcing the measure, Treasury released a Fact Sheet, explaining the details of how tax on earnings will be calculated for amounts above the $3 million balance.

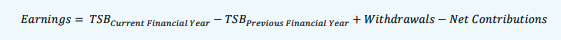

The fact sheet explained that earnings will calculated with reference to the difference in total super balance at the start and end of the financial year, adjusting for withdrawals and contributions.

Negative earnings can be carried forward and offset against this tax in future years’ tax liabilities.

Individuals will have the choice of either paying the tax out-of-pocket or from their superannuation funds.

The fact sheet also states that individuals who hold multiple superannuation funds can elect the fund from which the tax is paid. This tax will be separate to an individual’s personal income tax, similar to the existing Division 293 tax.

While the government intends to apply the measure to defined benefit interests, at time of writing, it has not released details on how defined benefit interests will be treated.

Treasury has proposed the following formula for calculating earnings in a financial year:

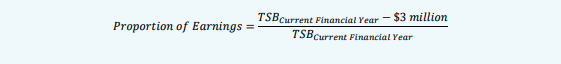

The proportion of earnings corresponding to funds above $3 million is calculated using the following formula:

The tax liability is calculated as follows:

The formula calculates the difference between the member’s total super balance for the current and previous financial years and adjusts for net contributions (which excludes contributions tax paid by the fund on behalf of the member) and withdrawals.

If an individual makes an earnings loss in a financial year, this can be carried forward to reduce the tax liability in future years. The calculation of earnings includes all notional (unrealised) gains and losses, similar to the way superannuation funds currently calculate members’ interests.

Commenting on the proposed tax calculation, SMSF Association chief executive Peter Burgess explained that as the ATO will be using an individual’s total super balance to calculate their earnings, this means it will include all notional (unrealised) gains and losses.

“This essentially means some members will be paying tax on unrealised earnings which is highly unusual,” he said.

Mr Burgess said the Association’s preferred approach would have been for the ATO to do a calculation of ‘notional earnings’ using a similar approach to the existing excess contributions tax regime.

What's next?

Treasurer Jim Chalmers has already indicated that the government will introduce enabling legislation to implement the measure “as soon as practicable”, despite the measure not commencing until July 2025.

“Further consultation will be undertaken with the superannuation industry and other relevant stakeholders to settle the implementation of the measure,” he stated.

Since the announcement about the measure, there has already been discussion about what actions clients impacted by the proposed measure may want to take ahead of 1 July 2025.

In a recent article, legal documentation provider SuperCentral said the proposal is likely to encourage couples to equalise total super balances through contribution splitting, spouse contributions and non-concessional contributions for the low balance member.

Where there is one member of a couple with a balance below $3 million, SuperCentral stated that clients may want to consider transferring the excess super balance from the larger super account over to the spouse with the lower balance.

One potential way of achieving this could be by withdrawing amounts from super and recontirbuting those amounts as contributions to the low balance spouse.

“[Where possible], they could also consider applying small business concessions as super concessions for the spouse with the lower balance,” the firm added.

“They may also consider whether to reduce the individual's super balance and instead hold wealth in other vehicles such as discretionary trusts or investment companies, or in housing investment for themselves or their children,” it said.

“However, withdrawing investments from super is generally a one-way street so any transfer of wealth out of the super system should be carefully considered.”

About the author