Gender super gaps narrows for SMSFs

Women are closing the gender gap with retirement savings and this trend could continue as women’s participation in the workforce hits record high levels alongside greater action over building wealth for retirement.

Women retire on average with 23% less superannuation than men. The savings gap exists for many reasons: women on average earn less than men – Australia’s gender wages gap was around 23% in 2022 – and women take more career breaks than men or work part-time to raise children or care for family. These breaks can impede a woman’s ability to save for her retirement, which makes it even more important to save diligently during early working years.

Women catching up

The good news is that the gender gap in superannuation is closing for women with SMSFs.

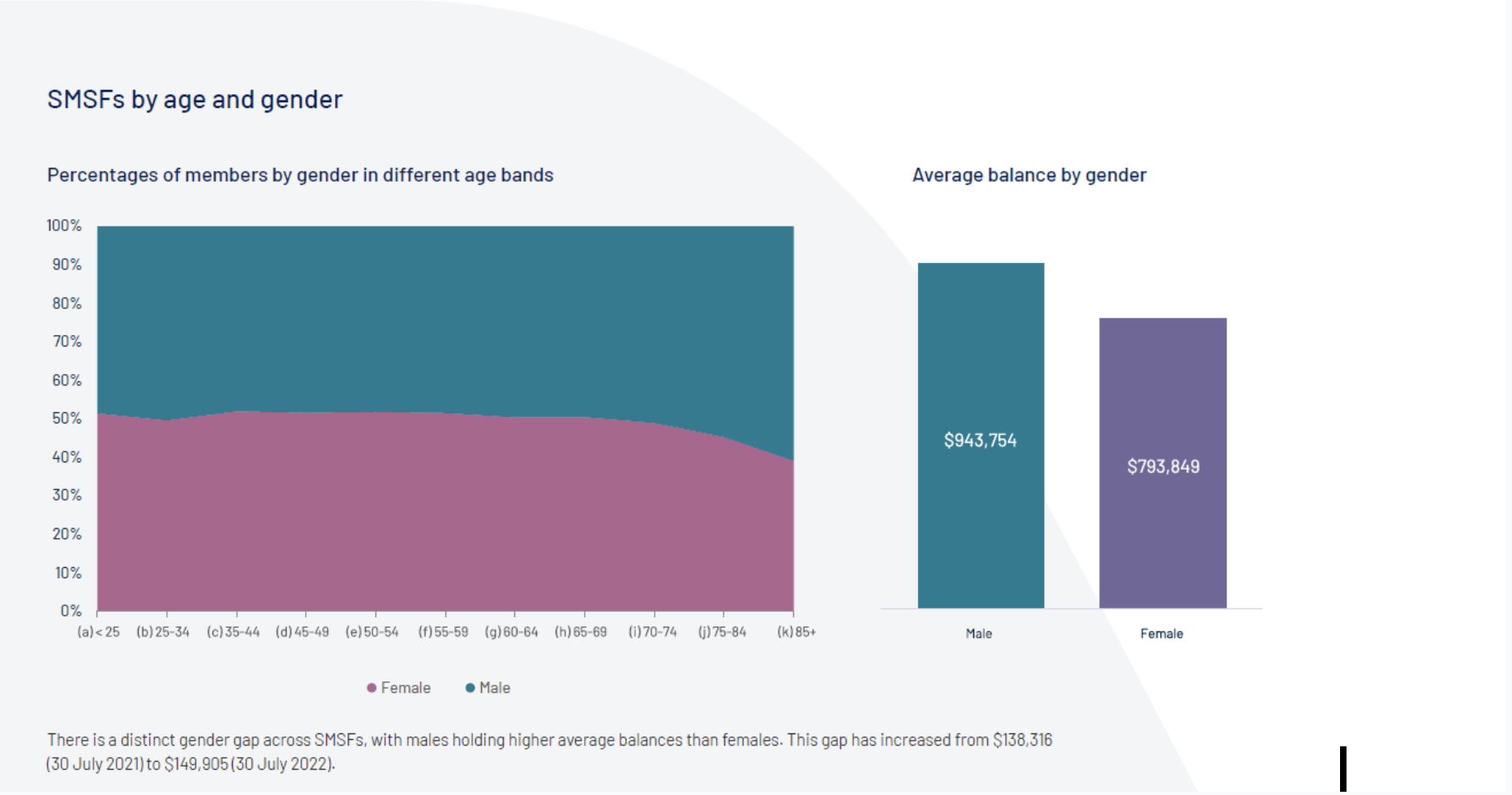

In recent years, women are becoming more actively engaged in managing and growing their retirement savings and, since 2017, female balances have been growing faster than male balances, now representing 84% of male balances. As at 2022, the average balance for men was $943,754 versus $793,849 for women representing a gap of 16% with the gap narrowing slightly in 2021-22.

Source: 2022 Class Annual Benchmark Report: Trends shaping SMSF, a time for growth

The gender savings gap is expected to further diminish as women assert greater financial independence. Importantly, their participation in the workforce is striking record high levels; after several months of strong growth in female employment, up 81,000 in March and April 2023 alone, the female participation rate rose to a record high of 62.5 per cent, and their employment-to-population ratio also hit a historical high of 60.4 per cent. Simply put, more women than ever before are working and earning money enabling them to grow their superannuation.

While there is still a significant disparity between female and male super balances, industry changes and super reforms will encourage the gender gap in balances to narrow. Superannuation law allows concessional contributions made by one member of a couple to be transferred to the other member of the couple. This is a strategy commonly used to build up the superannuation balances in circumstances where one spouse may be earning more than the other.

Other legislative changes have made it easier for women to save for their retirement, including the removal last year of the $450 earnings threshold that was needed before employers paid super.

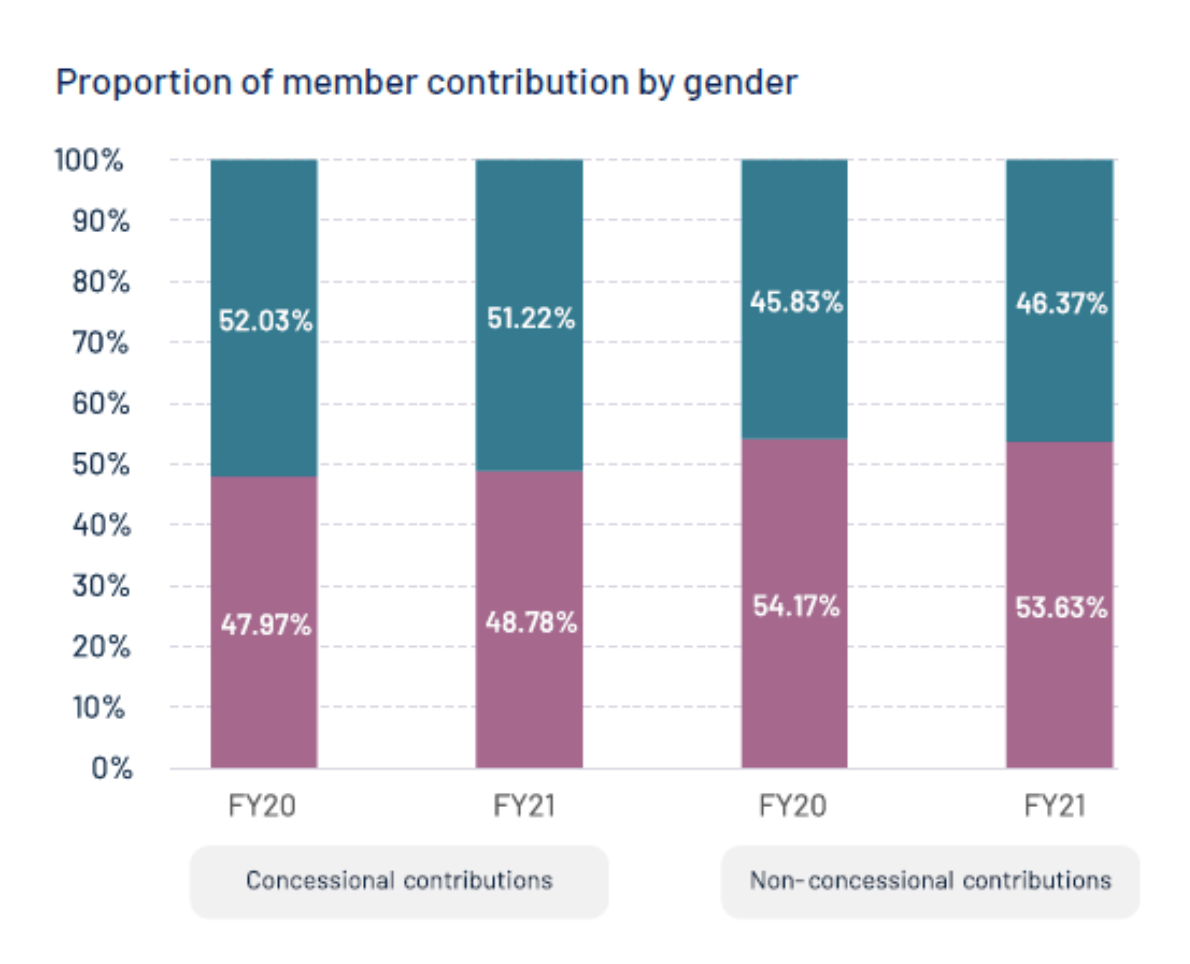

In a sign of increased female participation in the SMSF industry, females are also generally contributing more than men in non-concessional contributions, and almost the same as men in concessional contributions.

Source: Class Annual Benchmark Report 2022

Another way females are catching up to men is by making 'downsizer contributions' into super, with Class data showing 15% more female members are making downsizer contributions than men, indicating a strong confidence in SMSFs as a viable investment strategy. The average downsizer contribution increased by $15,000 in 2021-22 from the prior financial year with contributors taking advantage of higher property prices during the pandemic to free up equity and make super contributions.

Strategies to grow super balances

There are several strategies women can implement to help boost their superannuation balance. For example, the earlier women start contributing extra into their superannuation, the greater the compounding effect of investment returns over time. I recommend professional women seeking out a specialist SMSF adviser to develop a financial plan to help them meet their retirement goals.

Women who are part of a couple should also consider getting individual financial advice, to ensure their own retirement goals are met.

Having access to real-time information and the right technology to administer an SMSF may help; obtaining real-time member balance and investment performance information may encourage women to more closely monitor their super plans.

Outlook for women with SMSFs

While the gender gap remains and there is still work to be done, women are catching up. By having a financial plan, applying some simple strategies, and seeking the support of a specialist SMSF adviser, women will be well placed to build their wealth. Overall, the outlook is positive for women and superannuation and an SMSF may provide a great solution for women to meet their retirement objectives.

Jo Hurley is Class’s General Manager, Growth